What Is Life Insurance?

Life insurance’s sole purpose is to provide guaranteed financial security for your family in the event of an unfortunate situation, such as death. Your designated Life Insurance provider will give a tax-free lump sum payment to the beneficiaries of your choice in exchange for regular premium payments upon your death. Life insurance is an affordable way to make sure that your loved ones are protected. Your insurance will take care of your family’s financial needs when you will not be able to do so.

Why Do You Need Life Insurance?

If someone depends on you financially, you need life insurance. Life insurance is important as it protects your family financially when you are not able to do so. When you die your income stops but your family’s monthly bills and expenses will not stop. A life insurance payment will not only cover these monthly expenses but will also help to pay out your mortgage balance, funeral expenses and other debts and loans you will leave behind. Life insurance is a must if:

- You have a mortgage or monthly rent to pay

- You are the bread winner of the family

- You have monthly bills and expenses

- Your spouse depends upon you financially

- You have kids or old parents

- Your coverage from work is not sufficient

- You are a business owner

- You work in a high-risk job

When Do You Need Life Insurance?

You need life insurance if in case of your untimely death your family can’t:

- Pay off remaining mortgage

- Pay for kids future education

- Maintain current lifestyle

- Pay for emergency expenses

- Pay for funeral expenses

- Pay off other loans and debts

- Pay for estate & capital taxes

Life Insurance can also help:

- To provides income replacement for lost salary

- To leave a legacy for your loved ones

- As a source of retirement income

When You Should Buy Life Insurance?

The right time to buy life insurance depends on your family and financial circumstances which varies from person to person. When it comes to buying life insurance the best time is when you need it the least i.e. when you are young and healthy. Sooner you buy, the better, as it will become expensive with each passing year. You pay lower premiums when you buy young because you are healthy; as you get older, life insurance becomes more expensive due to old age and any health issues developed. You should keep reviewing your life insurance needs at each stage of life as life changes quickly and so should your life insurance.

Life Stages That Trigger the Need for Life Insurance:

- 1. Married or Getting Married

- 2. Starting a Family Soon

- 3. Buying Your First Home

- 4. Starting or Changing Jobs

- 5. Starting a Business

- 6. Planning to Retire

What Factors Will Affect Your Life Insurance Premiums?

Insurance company will take into consideration the following factors to determine your eligibility and premiums:

- Age: If you buy at a young age you save more as your premiums will be less.

- Gender: When compared to males; females are considered less risky and are less expensive to insure.

- Health: People who have health issues will pay more for life insurance as compared to healthy people.

- Family History: If you have a family history of certain chronic illness you may end up paying more for life insurance.

- Driving Record: A bad driving record could cost you more when it comes to life insurance premiums.

- Job: Risky jobs and dangerous occupations may impact your insurance premiums.

- Hobbies & Extreme sports: You may end up paying more if you like extreme sports or have risky hobbies.

- Coverage amount: Premium is directly related to coverage amount and you will have to pay more if you want a larger coverage amount.

- Type of policy: Premium for a Term policy will be cheaper than a permanent policy.

- Smoking status: Smokers will have to pay more as compared to non-smokers.

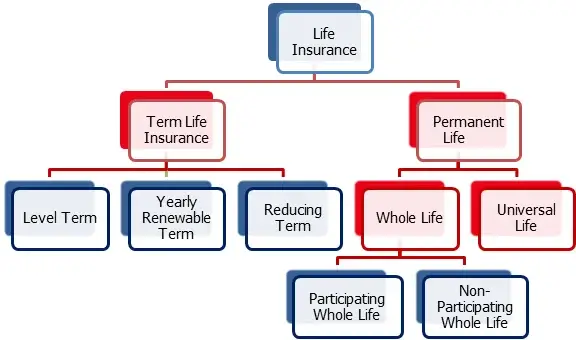

Types of Life Insurance:

There are basically two types of life insurance – Term life insurance and Permanent life insurance. Each has its own unique features designed to meet different needs. Term life insurance provides temporary protection for your temporary short term needs whereas permanent life insurance is meant to provide permanent protection for your permanent long term needs. Life insurance not only protects your family’s financial future but it can also be an integral part of your financial plan to maximize your wealth and to protect your estate. Many people start out with term life insurance for their temporary needs and may move to permanent life insurance as their needs change.

Types of Life Insurance

Selection of a life insurance plan will depend on your specific needs and requirements. You are unique, and your coverage should be unique as well. At Family Care Insurance, we provide personalized solutions tailored to your individual needs because we know that no family is the same so why should their coverage be? Give us a call and let’s design a customized insurance plan to secure your family’s future.

How Much Life Insurance Do You Need?

Not sure how much coverage you need? Let’s calculate the amount of coverage you need by clicking the Life Insurance Calculator button below.

LOOKING FOR AN INSURANCE QUOTE?

YOU HAVE COME TO THE RIGHT PLACE!

We will help you find the right coverage & policy.