Visitors Insurance

Visitors insurance is a specially designed travel policy that provides emergency medical insurance to the visitors of Canada. Although visitors travel insurance, is not a mandatory requirement, it is highly recommended for all Canadian visitors, as hospital medical bills in Canada are very expensive. The Canadian healthcare system does not offer any free medical care to visitors, and non-residents visiting Canada are responsible for their own medical care. Since visitors will not have access to the Canadian Healthcare system, it can cost several thousands of dollars due to the high cost of medical care in Canada. You may end up paying thousands of dollars in medical expenses out of pocket without visitors insurance for any medical emergencies. Without Emergency Medical Insurance, you could have to pay out-of-pocket for medical emergencies as follows:

- The average cost for a hospital stay in Canada is $7,000 per day

- An Intensive Care Unit could cost $6000 per day on average

- An emergency hospital visit costs $1000 per visit in Ontario

- Private hospital accommodations could cost $4000 per day

- Ground Ambulance costs $240 in Ontario and air ambulance could cost as high as $18000 for visitors in some provinces

Visitors insurance helps to protect visitors from unforeseen medical emergencies and expenses from sudden illness or accident. If a claim arises visitor’s medical insurance will pay all the above mentioned medical expenses. It’s always advisable to buy travel insurance from a Canadian company because they work with Canadian hospitals and clinics and may offer you direct billing and will also help to accelerate the claim process. Visitors Insurance is affordable and easy to get and ensures that you are covered while you are visiting family and friends in Canada. Visitors to Canada include:

- Tourists and visitors visiting from another countries

- Returning Canadian waiting for their provincial health care coverage to begin

- New immigrants waiting for their provincial health coverage

- International students studying in Canada

- Foreign workers and all other temporary residents

Types of Visitors Insurance

There are two types of Visitors Emergency Medical Insurance plans:

- Basic Plans: These plans will provide very basic required coverage for prescription medicine, dental care, and repatriation. Pre-existing conditions coverage is not included in basic plans. These plans are suitable for visitors who are not on any daily prescribed medications, are in excellent health, and require a budget friendly plan

- Enhanced Plans: These plans will provide higher coverage for prescription drugs, dental care, and repatriation. Stable pre-existing conditions coverage is included in enhanced plans. These plans are expensive as compared to basic plans and are recommended for visitors looking for additional and upgraded benefits

Visitors Insurance is designed to cover your emergency medical expenses during your stay in Canada. You can choose a basic or enhanced plan depending on your need and budget. The premiums and coverage will differ among various providers and will cover most of the emergency medical expenses up to the sum insured but a routine doctor visit or elective treatment would not be covered under this type of policy. Some insurers will also pay death benefit in the event of death of the insured. Some plans allow the visitors to have side trips to other countries provided that 50% of the trip duration is spent in Canada. But not all the policies are created the same. So always make sure to shop around for the best policy that suits your needs and budget. Compare the policies not only for the premiums but also for their benefits, coverage and exclusions because the cheapest option is not necessarily the best option. At Family Care Insurance we can customize plans as per your specific requirements and can help you find the best plans at very affordable premiums.

What does Visitors Insurance Cover?

Although each provider will have their own benefits and coverage limits but most insurers provide the following coverages:

- Emergency Medical Expenses

- Hospitalization Expenses

- Prescription Medications

- Accidental Death & Dismemberment

- Ambulance Services

- Routine Doctor’s Fees

- Diagnostic, Laboratory & X-rays

- Emergency Dental Care

- In-Hospital Nurse Service

- Accommodations & Meals

- Emergency Return Home

- Repatriation of Remains

- Cremation/Burial At Destination

- Coverage for Side Trips

- Follow-Up Visits

What Factors Will Affect Your Visitors Insurance Premiums?

Following factors will determine eligibility and premiums for Visitors Travel Insurance:

- Age of the applicant

- Health history of the applicant

- Length of the policy

- The amount of coverage

- Deductible amount

- Type of plan

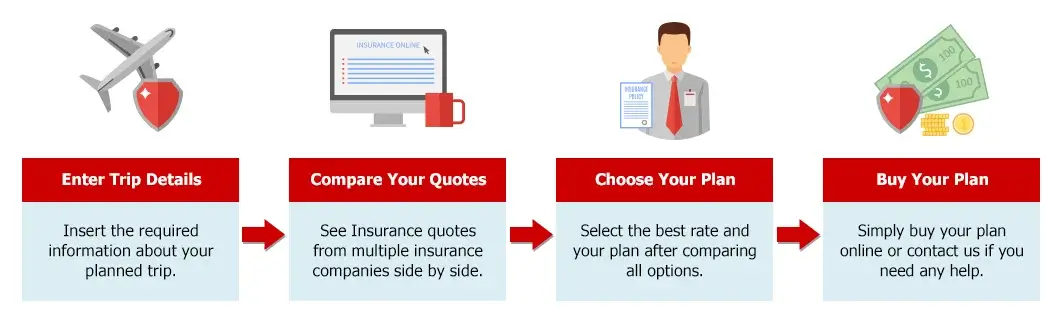

Try Our Online Quote, Compare and Buy Tool

Are you looking for the best Visitors Emergency Medical Insurance rates? Are you exhausted from shopping around and comparing rates from different providers? Don’t be… Family Care Insurance is here to take care of it for you! Our quoting service is absolutely free and allows you to compare quotes from the leading insurance companies in Canada. It’s quick and easy and it saves you time and money. We’ll show you multiple rates in one place, enabling you to compare coverage and pricing. We will provide you with the lowest rates for the coverage you need from the top insurance companies. Look no further and try our quick comparison tool to compare quotes. You can see the cheapest insurance rates and compare the features and benefits of different policies and can even buy your policy online hassle free in just minutes.

How to Get Your Visitors Insurance Quotes?