Super Visa

Super Visa is a multi-entry visa that permits the parents and grandparents of Canadian citizens and permanent residents to visit their family in Canada. It’s a visa that allows multiple entries for a period of up to 10 years and allows them to stay in Canada for up to 5 years at a time without the need for renewal of their status. A multiple entry Visitor Visa limits the stay only up to 6 months and hence Super Visa is a better option.

Effective July 4,2022 the following changes to the parents and grandparents Super Visa are taking effect:

- The length of stay in Canada will increase to a maximum of 5 years per trip. Up from the previous 2 year maximum

- Applicants will be able to buy Super Visa insurance from designated International insurance companies rather than only from Canadian insurers

- People with a Super Visa will be able to request to extend their stay for up to two years while in Canada already

Being able to extend your Super Visa for another two years while already in Canada effectively means that each trip to Canada could be up to 7 years for your parents and grandparents.

Super Visa Insurance

Super Visa insurance is a travel insurance policy that is specially designed for super visa applicants. It is a legal requirement for all super visa applicants to provide proof that they have valid emergency medical insurance for at least one year with minimum coverage of $100,000.

Since Super Visa holders will not have access to the Canadian healthcare system, Super Visa Insurance acts as protection from financial hardship in the event of medical emergencies. It helps pay for health care, prescription drugs, hospital stays, and repatriation. Your Super Visa insurance policy should be:

- Valid for at least one year from the date of entry

- Provides a minimum of $100,000 coverage

- Covers emergency health care, hospitalization and repatriation costs

- Be valid and available for review by a port of entry officer at each entry

Eligibility requirements to apply for a Super Visa

Not everyone is eligible for a super visa. To be eligible for a super visa:

- You must be the parent or grandparent of a Canadian citizen or Canadian permanent resident

- Your Canadian child or grandchild will have to provide a written letter promising to financially support you during your stay

- Your child or grandchild meets the minimum income requirement (LICO threshold) and provides a copy of their Canadian passport or PR Card

- You will need to pass a medical exam to show you are medically fit to enter into Canada

- You must prove that you have sufficient medical insurance from a Canadian insurance company

Types of Super Visa Insurance

There are two types of Super Visa Insurance plans:

- Basic Plans: These plans will provide very basic required coverage for prescription medicine, dental care, and repatriation. Pre-existing conditions coverage is not included in basic plans. These plans are suitable for visitors who are not on any daily prescribed medications, are in excellent health, and require a budget friendly plan

- Enhanced Plans: These plans will provide higher coverage for prescription drugs, dental care, and repatriation. Stable pre-existing conditions coverage is included in enhanced plans. These plans are expensive as compared to basic plans and are recommended for visitors looking for additional and upgraded benefits

Super Visa Insurance is designed to cover your emergency medical expenses during your stay in Canada. You can choose a basic or enhanced plan depending on your needs. Both basic and enhanced plans will provide the minimum required coverage of $100,000 but the premiums and coverage will differ among various providers. Make sure to shop around for the best policy that suits your age, medical background and coverage needs, especially if you have pre-existing medical conditions. Compare the policies not only for premiums but also for their benefits, coverage and exclusions because the cheapest option is not necessarily the best option.

What does Super Visa Insurance Cover?

Although each provider will have their own benefits and coverage limits most insurers provide the following coverages:

- Emergency Medical Expenses

- Hospitalization Expenses

- Prescription Medications

- Routine Doctor’s Fees

- Diagnostic, Laboratory & X-rays

- Emergency Dental Care

- Emergency Return Home

- Repatriation of Remains

- Cremation/Burial At Destination

- Accidental Death & Dismemberment

- Ambulance Services

- In-Hospital Nurse Service

- Accommodations & Meals

- Coverage for Side Trips

- Follow-Up Visits

Why Choose Family Care Insurance for Your Super Visa Insurance?

Family Care Insurance offers convenient, flexible and affordable plans that meets Super Visa application requirements, and provides:

- Up to 45% Deductible Discount

- Very Affordable Monthly & Yearly plans

- 100% Money Back if Visa Denied

- Prorated Refund on Early Returns if There Is No Claim

- COVID-19 Coverage Available

- Pre-existing Conditions Coverage Available

What Factors Will Affect Your Super Visa Insurance Premiums?

Following factors will determine eligibility and premiums for Super Visa Insurance:

- Age of the applicant

- Health history of the applicant

- Length of the policy

- The amount of coverage

- Deductible amount

- Deductible amount

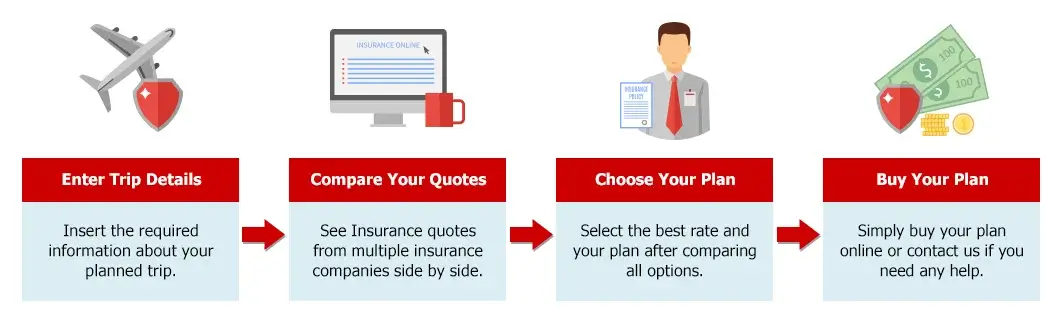

Try Our Online Quote, Compare and Buy Tool

Are you looking for the best Super Visa Insurance rates? Are you exhausted from shopping around and comparing rates from different providers? Don’t be… Family Care Insurance is here to take care of it for you! Our quoting service is absolutely free and allows you to compare quotes from the leading super visa insurance companies in Canada. It’s quick and easy and it saves you time and money. We’ll show you multiple rates in one place, enabling you to compare coverage and pricing. We will provide you with the lowest rates for the coverage you need from top insurance companies. Look no further and try our quick comparison tool to compare quotes and find out how much super visa insurance costs for you. You can see the cheapest insurance rates and compare the features and benefits of different policies and can even buy your policy online hassle free in just minutes.

How to Get Your Super Visa Insurance Quotes?