Travel Insurance

Travel insurance is intended to cover you for unforeseen medical and other emergencies that can happen while travelling within Canada or even internationally such as a trip cancellation, flight delays, lost baggage, or medical emergencies and accidents. No one ever thinks that they will get sick or injured or that their belongings will get lost or stolen while travelling, but it certainly does happen. Travel Insurance protects your travel plans from financial shocks from unexpected medical expenses and other emergencies and gives you extra protection and peace of mind.

If you are travelling out of the country or province it’s advisable to get travel insurance before you leave as the financial cost of something going wrong overseas is very high. Your provincial health care plan will neither cover you overseas nor out of your province. It can cost you several thousands of dollars due to the high cost of medical care in other countries for any medical emergencies. Even when you are travelling with in Canada your provincial health care plan may not cover all of your medical bills out of province and you may end up paying thousands of dollars in medical expenses out of pocket. Travel Insurance is affordable and easy to get and ensures that you are covered while you are away so that you can focus on enjoying your trip.

Types of Travel Insurance

There are many types of travel Insurance plans for Canadians traveling either for leisure or business purposes and you can pick a plan as per your needs.

1. Emergency Medical Travel Insurance Plan: When you leave your home country or province your provincial health care plan will not travel with you. That’s where an emergency medical travel insurance plan will cover you for emergency medical and emergency evacuations expenses. It is a temporary medical insurance plan that provides coverage for the length of your trip.

2. Trip Interruptions & Cancellation Plans: Trip interruptions and cancellation insurance covers you for the unforeseen interruptions or cancellations to your trip. This may include cancelled trips, delayed flights and missed connections, lost or stolen baggage, as well as cancelled hotel accommodations.

3. All Inclusive Plans: All inclusive plans cover you for medical emergencies, lost and stolen baggage and trip interruptions and cancellations. It is all in one plan and is generally the most expensive travel insurance plan of all.

4. Single Trip Plan: This plan is designed to cover you for a single trip and is the most affordable travel insurance plan available.

5. Multi Trip Plan: This plan is meant for frequent travellers and will cover you for a set period of time usually for one year and is an annual travel insurance plan. It is a very flexible plan and is more expensive than a single trip plan.

Why Do You Need Travel Insurance

- You may fall sick or get injured during your trip and your provincial health insurance plan will not cover your medical bills while you are outside Canada

- Your provincial health plan will never pay your medical bills up front and sometimes may cover only a portion of it or not cover the costs of your medical care outside of Canada at all

- Overseas hospitals can be very expensive and may demand upfront cash payments before the medical treatments

- Hospitals and medical institutions may not treat you without insurance or upfront cash payment if you need emergency medical treatment overseas

- The Canadian Government will not pay your medical bills outside of Canada if you are travelling without travel insurance

Important Points to Keep in Mind When You’re Researching for Travel Insurance

Analyze your needs and carefully research a suitable policy. Verify the terms, conditions, limitations, benefits, exclusions and requirements of your insurance policy before you leave Canada. Always ask the following questions while buying a travel insurance plan:

- What is covered and what are the benefits?

- What is excluded and what are the limitations of your plan?

- What are the terms and conditions of your insurance policy?

- Is there a deductible and how much? Plans with deductibles are less expensive than full coverage.

- Is your plan renewable from abroad while travelling if required and maximum length of coverage?

- Are there any restricted regions or countries where the plan will provide limited or no coverage?

- What is the claim process?

- Medical costs for hospitalization for illness or injury will be paid upfront directly at destination or will be reimbursed later?

- Are COVID-19 related medical expenses covered?

- Are COVID-19 Quarantine costs covered if you get infected during your trip?

- Are you covered for extended stays outside Canada due to emergencies?

Your Travel Checklist

Make sure you complete the following checklist before your departure.

- Review your policy for benefits, limitations, and exclusions

- Check the Canadian government’s travel website for the travel advisory section for your destination @ www.travel.gc.ca

- Take your provincial health card with you before leaving for your travel destination

- Carry the emergency travel assistance provider's complete contact information

- Keep receipts for your flight, car rental, hotel accommodation, etc. for travel proofs as these are required just in case you make a claim

- Carry your travel insurance information with you & leave a copy of the information with family or relatives at home

What to do During a Medical Emergency while Travelling?

- Call your emergency travel assistance provider immediately after an accident and before you receive medical care

- Get the pre-approval from the insurer before you go for major treatments and emergency surgeries required

- Collect all the medical reports and original expense receipts before you leave the country as you will need original receipts to submit along with a claim

- Keep a copy of all the receipts and documents for your files

Benefits of Travel Insurance

- 1. Emergency Medical Expenses: Covers medical expenses incurred due to illness or accident while traveling.

- 2. Emergency Medical Evacuation: Emergency evacuation to the home country is covered up to the sum insured.

- 3. Repatriation of Remains: Covers the funeral expenses or expenses of repatriating the remains back to your home country, when deceased.

- 4. Ambulance Services: Covers the expenses for ground or air emergency ambulance services.

- 5. Emergency Dental Expenses: Provides coverage for dental emergencies

- 6. Hospital Expenses: Pays a daily allowance as stated in the policy in the event of hospitalization either due to sickness or accidents.

- 7. Accidental Death & Dismemberment: Provides additional benefit in case of death or dismemberment of the insured due to an Accidental bodily injury during the trip.

- 8. Trip Cancellation: Covers the cost of your travel expenses up to the sum insured if cancelled due to unforeseen circumstances.

- 9. Flight Delays & Trip Interruptions: Covers the expenses due to delayed flights, missed connections or flight cancellations and provides coverage for rebooking and rescheduling in case of an unforeseen situation preventing you from returning on your scheduled return date.

- 10. Lost or Stolen Baggage: Covers you in the event of lost, stolen or damaged baggage while travelling.

Without a Travel Insurance plan, you will have to pay for these expenses out of your own pocket. That’s why Travel Insurance must be the first thing on your list when it comes to planning your trip and the one thing that you should never overlook. We are here to help you with the customized travel insurance plan as per your needs for your safe and peaceful trip. Before you plan your next trip, make sure you are adequately covered. Whether you need a single trip insurance plan or a multi trip annual plan or even if you are looking for a snowbird travel insurance plan – we have the best travel insurance plan for you.

We will analyse your needs and budget and will shop around with several insurance companies, to get you the best possible rates, while saving you time and money. Let’s talk about your coverage options or get a quick quote today.

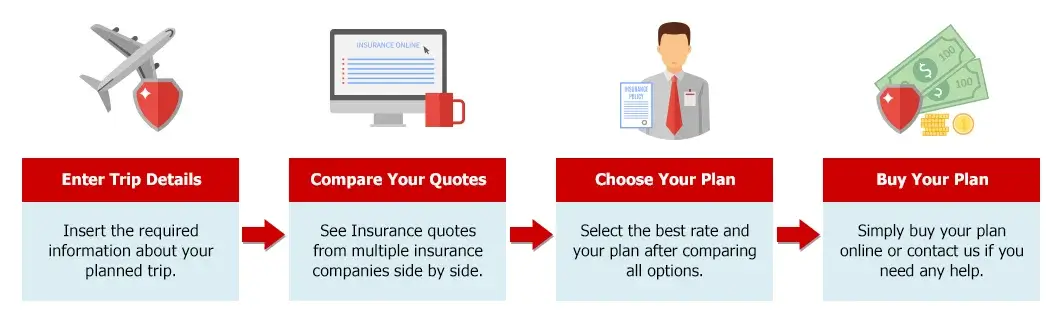

How to Get Your Travel Insurance Quotes?